Protect your church and its community

The first Baptist Insurance article of 2022 highlights the handy risk calendar for churches, and its home emergency cover

Church planning for 2022

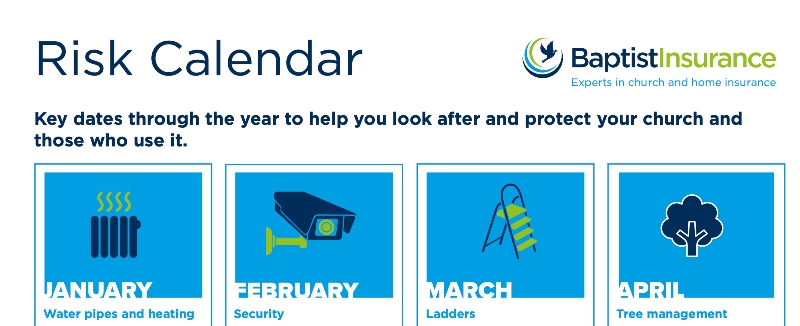

Baptist Insurance has developed a handy risk calendar, which gives important reminders on the seasonal risks your church might face, in addition to some guidance to help you look after and protect those who use it.

Guidance ranges from water pipes and heating, security, tree management, events, fire risk assessment and many more. Download a copy from the website today.

Home emergency cover

At Baptist Insurance, home emergency cover is included in all home insurance policies as standard and gives 24-hour access to rapid-response contractors.

24-hour support for home emergencies

Home emergency cover is included in the annual premium and there is also no excess to pay if you use it. They can pay up to £1,000 for call out, labour, parts and materials (including VAT) for each repair.

What does home emergency insurance cover?

It covers emergencies which are a risk to your home in the hope that fast treatment will limit damage. Emergencies are defined as sudden, unexpected and those which require immediate corrective action to prevent any damage or further damage to your home, make your home safe and secure and relieve any unreasonable discomfort, risk or difficulty to you.

Cover is available for incidents related to:

-

Roof damage

-

Plumbing and drainage

-

Main heating system

-

Domestic power supply

-

Toilet unit

-

Home security

-

Vermin

To find out more about the cover and what a Baptist home insurance policy provides, please visit the website or call 0345 070 2223

Want to know more?

Baptist Insurance wants to provide you with the help and advice that you need to continue to protect your church and its community. For additional guidance or information on church and home insurance, please visit the website.

Baptist Times, 17/01/2022